04:25 PM Saturday, 27 July 2024

1800 137 0600

Toll Free

* 9:00 AM to 5:30 PM

1800 137 0600 Toll Free * 9:00 AM to 5:30 PM

-

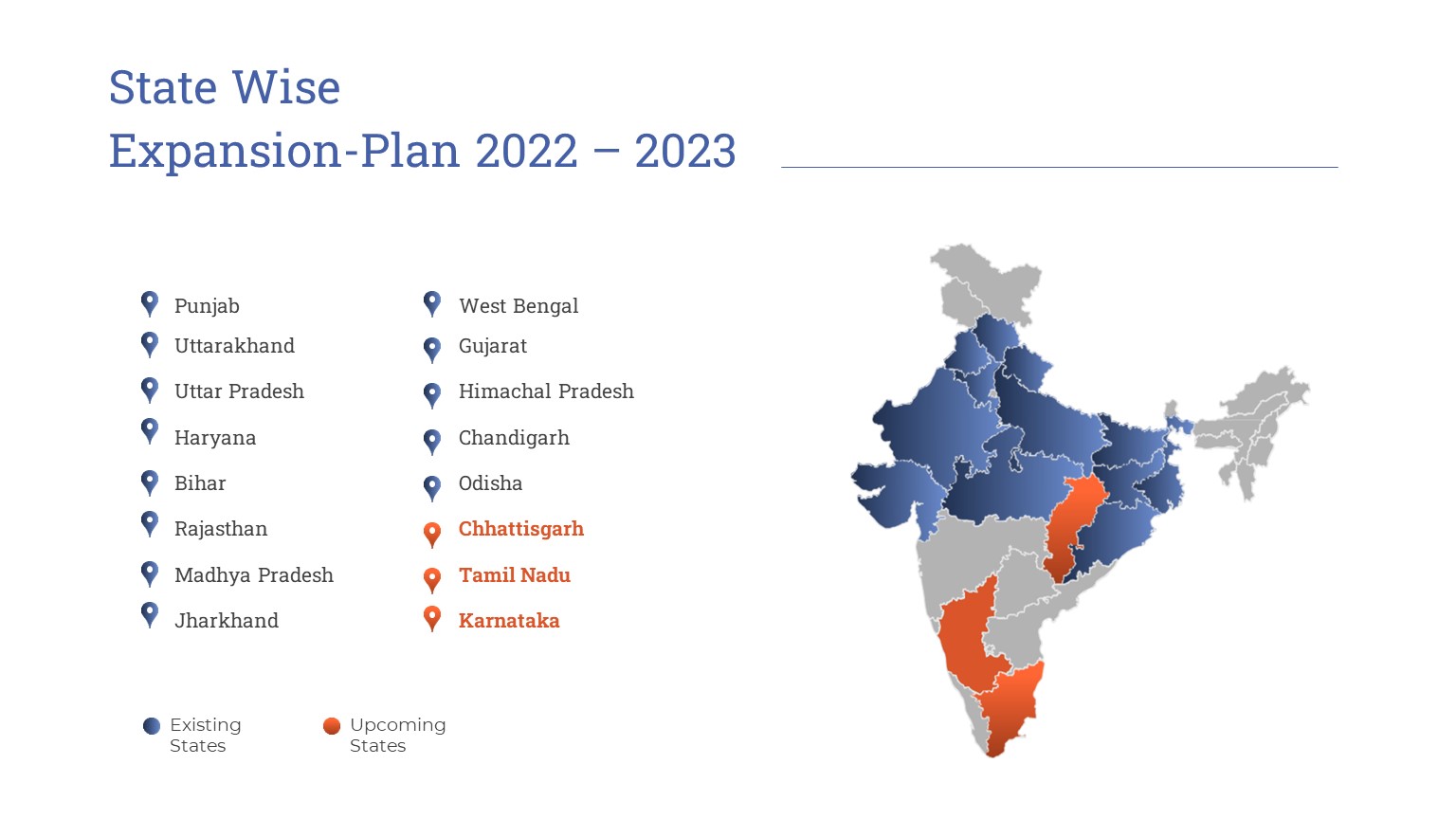

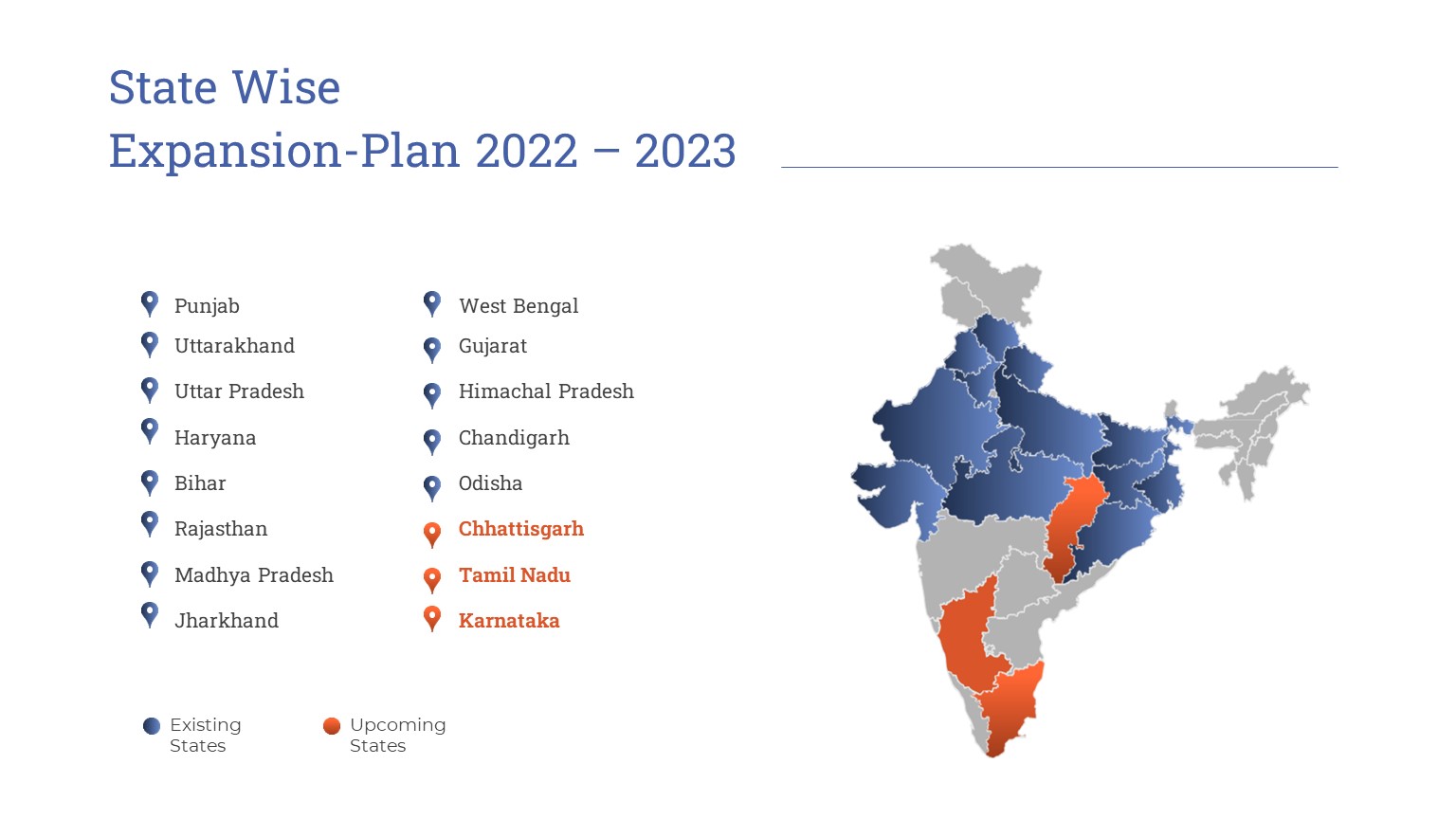

Area of Operation

MML has scripted its legacy over the past one decade and the institutions geographic footprint spans over 12 States and 2 Union Territories with 415 branches. This footprint now extends from Punjab to Himachal Pradesh, Haryana to Jammu & Kashmir, touching lives in Bihar, Gujarat, Jharkhand, Odisha, Uttar Pradesh, Madhya Pradesh, Uttarakhand, West Bengal, and Chandigarh.

-

Loan Products

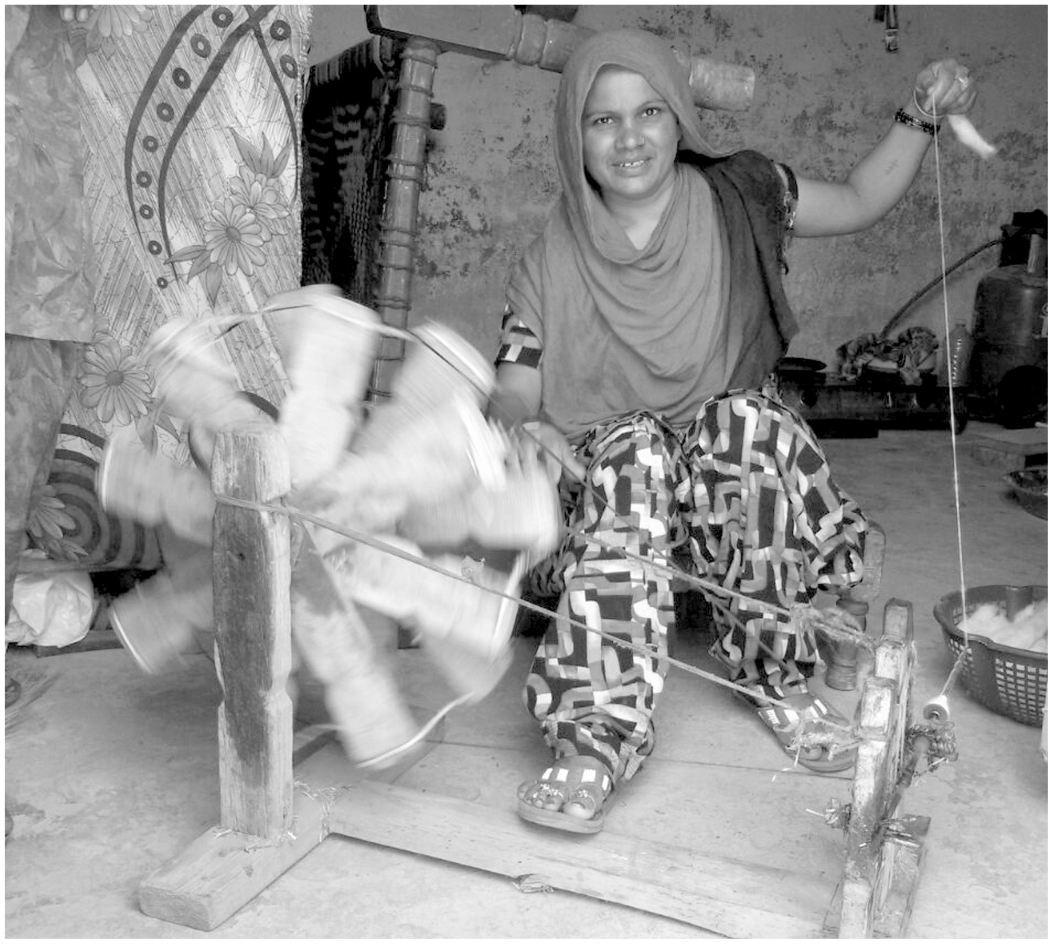

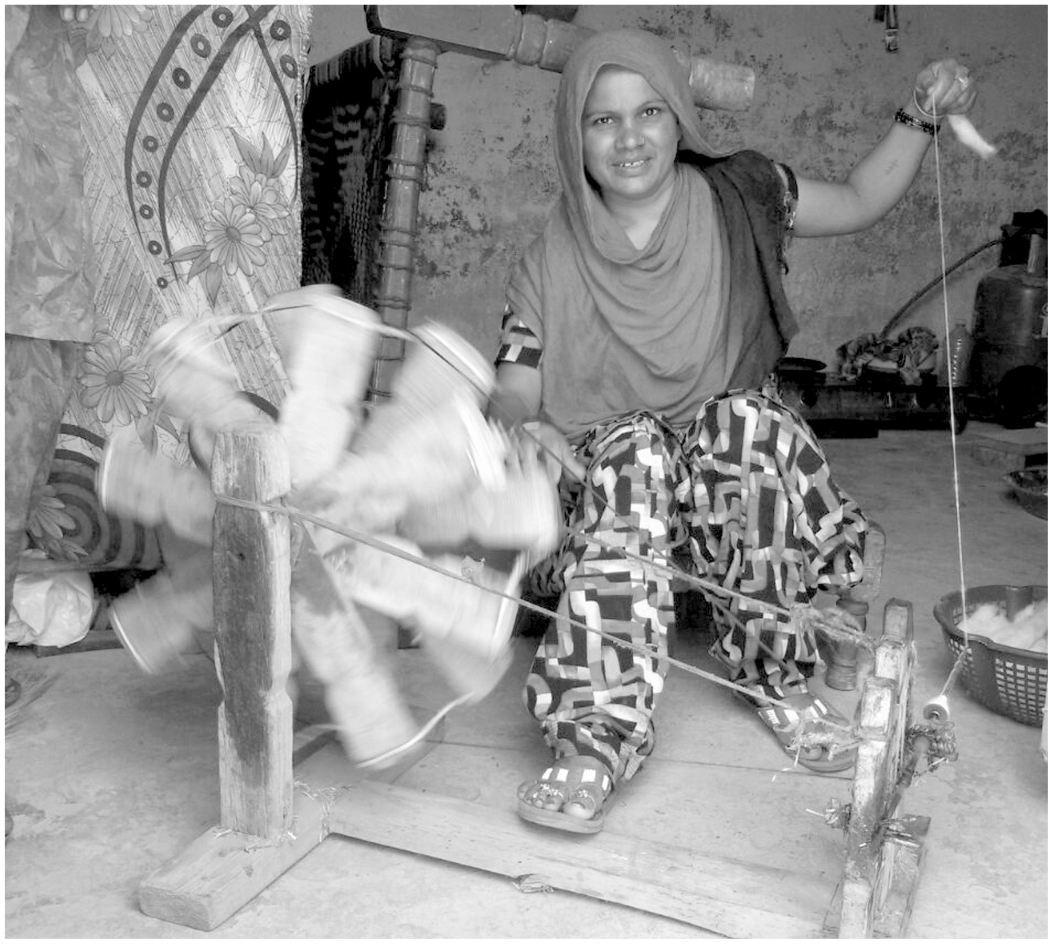

Micro Enterprise Loans

We encourage entrepreneurship amongst women as sustainable source of livelihood by providing business loans for working capital. Business Loans give the economically active women access to finance in order to support their micro enterprises. Members use this to cater to their diverse business needs such as tools and equipment purchase, stock purchase, working capital etc.

Business Loan

(Joint Liability Group Category)Tenure Loan Size (Rs.) Insurance Premium Interest Rate Reducing Loan Processing Fees & GST Repayment Frequency Upto 24 Months 11,000- 70,000 At actuals 25.50% 1% on PF & applicable GST Lunar Individual Loan

( Dairy & Udaan Loan)Tenure Loan Size (Rs.) Insurance Premium Interest Rate Reducing Loan Processing Fees & GST Repayment Frequency Upto 24 Months 60000-150000 At actuals 28.00% 1% PF + applicable GST Monthly Credit Plus Products Loan Tenure Loan Size (Rs.) Insurance Premium Interest Rate Reducing Loan Processing Fees & GST Repayment Frequency Upto 18 Months 1399/2300/3699/9600 At actuals 26.00% 1% PF + applicable GST Lunar Education Loan Tenure Loan Size (Rs.) Insurance Premium Interest Rate Reducing Loan Processing Fees & GST Repayment Frequency Upto 12 Months 11,000 – 20,000 At actuals 26.00% 1.50 % on PF & applicable GST Lunar Wash Loan Tenure Loan Size (Rs.) Insurance Premium Interest Rate Reducing Loan Processing Fees & GST Repayment Frequency Upto 24 Months 11,000 – 30,000 At actuals 26.00% 1.50 % on PF & applicable GST Lunar MEL Tenure Loan Size (Rs.) Insurance Premium Interest Rate Reducing Loan Processing Fees & GST Repayment Frequency 24-36 Months 150,000 – 300,000 At actuals 28.00% 1.50 % on PF & applicable GST Monthly The below interest rates are applicable from 30/06/2024 Microfinance loan – Product name Minimum Interest Rate* (%) Maximum Interest Rate* (%) Average rate of interest in June 30, 2024 (%) Average Processing Fees (% of the loan) ROI Effective from Business Loan 25.50% 25.50% 25.50% 1% 01-Jun-22 Credit Plus Product 25.50% 25.50% 25.50% 1% 01-Jul-23 Wash Loans 25.50% 25.50% 25.50% 1% 01-Aug-22 In case, members have more than one product, after giving product wise details as above, the blended average should also be given as below: All microfinance loans (To reflect all types of loans) Minimum Interest Rate* (%) Maximum Interest Rate* (%) Average rate of interest in June 30, 2024 (%) Average Processing Fees (% of the loan) All Microfinance Loans 25.50% 25.50% 25.50% 1% Non Microfinance Loans Minimum Interest Rate* (%) Maximum Interest Rate* (%) Average rate of interest in June 30, 2024 (%) Average Processing Fees (% of the loan) ROI Effective from Individual Loan 26.00% 26.00% 26.00% 1.50% 01-Jan-24 Note: The Company does not collect any penal interest/charges from its borrowers for delay payment or for pre-closing their loans.

-

Insurance Services

Midland endeavours to safeguard its members and their families, even in the face of life’s uncertainties. In case of an unfortunate event, our insurance coverage not only ensures financial recovery but also provides a pivotal support to their families.

Midland Microfin provides carefully curated insurance options and has strategically placed itself with top-tier insurance providers, including HDFC Life and Kotak Life for life insurance coverage, as well as Future Generali, Acko, ICICI Lombard, Niva Bupa, and SBI General for general insurance solutions. This collaboration empowers us to extend accessible life insurance options to our borrowers and their spouses at exceptionally affordable premiums. With HDFC Life and Kotak Life as our esteemed life insurance partners, we deliver comprehensive coverage, ensuring the financial security of our clients and their families during unforeseen circumstances.

These strategic affiliations underscore our commitment to providing our valued customers with dependable and extensive insurance choices tailored to their unique needs. Furthermore, in adherence to the Reserve Bank of India’s guidelines, we transparently convey the chargers incurred by members and their spouses. The financial security of our members is our top priority, and we are determined to provide world class services and experiences to our clients.

-

Operational Highlights

As on June 30, 2023

States & UT 12&2 Districts 187 Villages Covered 46,877 Branches 376 Joint Liability Groups 140,142 Active Borrowers 735,226 Total Borrowers 1,573,414 No. of Centers 116,748 Maximum Loan Amount 150,000 Average Ticket Size 41,237 Cumulative Loan Disbursement (Rs.) ₹73,39,85,57,648.00 $89,50,45,499.50 Loan Disbursed in FY 23-24 (Till June 30,2023) (Rs.) ₹3,38,93,23,785.00 $4,13,30,498.82 Loan Outstanding (Rs.) ₹19,00,09,51,411.00 $23,17,03,681.81 Loan End Use Verification 1 Equity Share Capital ₹45,57,01,620.00 $55,56,971.38 Preference Share Capital ₹12,06,50,000.00 $14,71,244.71 Preference Share Capital-CCPS ₹41,57,33,850.00 $50,69,591.60 Total Assets (Rs.) ₹19,19,02,02,779.00 $23,40,11,473.55 Total Staff 3,567 -

Customer Testimonials

Member Name : Paramjit Kaur W/o Varinder Singh

Member Name : Paramjit Kaur W/o Varinder Singh

R/o Village Jarkhar Distt. Ludhiana

I am associated with Midland Microfin Limited from last 3years. I have taken loan of Rs. 15000/- two times from Midland Microfin Limited. I took the loan for Business Expansion. I am very happy and now I earn good amount and is able to fulfil all my needs. Member Name : Usha Rani W/o Lt. Ashok Kumar

Member Name : Usha Rani W/o Lt. Ashok Kumar

R/o Gandhi Basti Distt. Faridkot.

I am associated with Midland Microfin Limited from last 2years. After The death of my husband I decided to start my own business of stitching clothes and for that purpose I needed money. At that time I took loan from Midland Microfin Limited for starting my business and I am thankful to Midland Microfin Limited who helped me in the time of my need. Now I have good income and can take care of my family. Member Name : Sita Devi w/o Sanjay

Member Name : Sita Devi w/o Sanjay

R/o Pathana Mohalla Panipat

I used to sell Bed sheet, Pillow covers and other covers by making designs on them. I took loan from Midland Microfin Limited and invested the same in my business. It helped me to expand my business. I want Midland Microfin Limited to provide loan to other people like me so that they can also grow their business. I am very thankful to Midland Microfin Limited. Member Name : Gita w/o Jagdish

Member Name : Gita w/o Jagdish

R/o village Rahda Distt. Assandh

I took loan from Midland Microfin Limited to expand my stitching business, it not only helped my business to grow but also increased my self-confidence. I wish to stay connected with Midland Microfin Limited in future as well so that I can further grow my business. Now I can fullfill the needs of my family, growth in business has helped improve the financial condition of our family.

Area of Operation

MML has scripted its legacy over the past one decade and the institutions geographic footprint spans over 12 States and 2 Union Territories with 415 branches. This footprint now extends from Punjab to Himachal Pradesh, Haryana to Jammu & Kashmir, touching lives in Bihar, Gujarat, Jharkhand, Odisha, Uttar Pradesh, Madhya Pradesh, Uttarakhand, West Bengal, and Chandigarh.

Loan Products

Micro Enterprise Loans

We encourage entrepreneurship amongst women as sustainable source of livelihood by providing business loans for working capital. Business Loans give the economically active women access to finance in order to support their micro enterprises. Members use this to cater to their diverse business needs such as tools and equipment purchase, stock purchase, working capital etc.

| Business Loan (Joint Liability Group Category) |

|||||

| Tenure | Loan Size (Rs.) | Insurance Premium | Interest Rate Reducing | Loan Processing Fees & GST | Repayment Frequency |

| Upto 24 Months | 11,000- 70,000 | At actuals | 25.50% | 1% on PF & applicable GST | Lunar |

| Individual Loan ( Dairy & Udaan Loan) |

|||||

| Tenure | Loan Size (Rs.) | Insurance Premium | Interest Rate Reducing | Loan Processing Fees & GST | Repayment Frequency |

| Upto 24 Months | 60000-150000 | At actuals | 28.00% | 1% PF + applicable GST | Monthly |

| Credit Plus Products Loan | |||||

| Tenure | Loan Size (Rs.) | Insurance Premium | Interest Rate Reducing | Loan Processing Fees & GST | Repayment Frequency |

| Upto 18 Months | 1399/2300/3699/9600 | At actuals | 26.00% | 1% PF + applicable GST | Lunar |

| Education Loan | |||||

| Tenure | Loan Size (Rs.) | Insurance Premium | Interest Rate Reducing | Loan Processing Fees & GST | Repayment Frequency |

| Upto 12 Months | 11,000 – 20,000 | At actuals | 26.00% | 1.50 % on PF & applicable GST | Lunar |

| Wash Loan | |||||

| Tenure | Loan Size (Rs.) | Insurance Premium | Interest Rate Reducing | Loan Processing Fees & GST | Repayment Frequency |

| Upto 24 Months | 11,000 – 30,000 | At actuals | 26.00% | 1.50 % on PF & applicable GST | Lunar |

| MEL | |||||

| Tenure | Loan Size (Rs.) | Insurance Premium | Interest Rate Reducing | Loan Processing Fees & GST | Repayment Frequency |

| 24-36 Months | 150,000 – 300,000 | At actuals | 28.00% | 1.50 % on PF & applicable GST | Monthly |

| The below interest rates are applicable from 30/06/2024 | |||||

| Microfinance loan – Product name | Minimum Interest Rate* (%) | Maximum Interest Rate* (%) | Average rate of interest in June 30, 2024 (%) | Average Processing Fees (% of the loan) | ROI Effective from |

| Business Loan | 25.50% | 25.50% | 25.50% | 1% | 01-Jun-22 |

| Credit Plus Product | 25.50% | 25.50% | 25.50% | 1% | 01-Jul-23 |

| Wash Loans | 25.50% | 25.50% | 25.50% | 1% | 01-Aug-22 |

| In case, members have more than one product, after giving product wise details as above, the blended average should also be given as below: | |||||

| All microfinance loans (To reflect all types of loans) | Minimum Interest Rate* (%) | Maximum Interest Rate* (%) | Average rate of interest in June 30, 2024 (%) | Average Processing Fees (% of the loan) | |

| All Microfinance Loans | 25.50% | 25.50% | 25.50% | 1% | |

| Non Microfinance Loans | Minimum Interest Rate* (%) | Maximum Interest Rate* (%) | Average rate of interest in June 30, 2024 (%) | Average Processing Fees (% of the loan) | ROI Effective from |

| Individual Loan | 26.00% | 26.00% | 26.00% | 1.50% | 01-Jan-24 |

Note: The Company does not collect any penal interest/charges from its borrowers for delay payment or for pre-closing their loans.

Insurance Services

Midland endeavours to safeguard its members and their families, even in the face of life’s uncertainties. In case of an unfortunate event, our insurance coverage not only ensures financial recovery but also provides a pivotal support to their families.

Midland Microfin provides carefully curated insurance options and has strategically placed itself with top-tier insurance providers, including HDFC Life and Kotak Life for life insurance coverage, as well as Future Generali, Acko, ICICI Lombard, Niva Bupa, and SBI General for general insurance solutions. This collaboration empowers us to extend accessible life insurance options to our borrowers and their spouses at exceptionally affordable premiums. With HDFC Life and Kotak Life as our esteemed life insurance partners, we deliver comprehensive coverage, ensuring the financial security of our clients and their families during unforeseen circumstances.

These strategic affiliations underscore our commitment to providing our valued customers with dependable and extensive insurance choices tailored to their unique needs. Furthermore, in adherence to the Reserve Bank of India’s guidelines, we transparently convey the chargers incurred by members and their spouses. The financial security of our members is our top priority, and we are determined to provide world class services and experiences to our clients.

Operational Highlights

As on June 30, 2023

| States & UT | 12&2 |

| Districts | 187 |

| Villages Covered | 46,877 |

| Branches | 376 |

| Joint Liability Groups | 140,142 |

| Active Borrowers | 735,226 |

| Total Borrowers | 1,573,414 |

| No. of Centers | 116,748 |

| Maximum Loan Amount | 150,000 |

| Average Ticket Size | 41,237 |

| Cumulative Loan Disbursement (Rs.) | ₹73,39,85,57,648.00 |

| $89,50,45,499.50 | |

| Loan Disbursed in FY 23-24 (Till June 30,2023) (Rs.) | ₹3,38,93,23,785.00 |

| $4,13,30,498.82 | |

| Loan Outstanding (Rs.) | ₹19,00,09,51,411.00 |

| $23,17,03,681.81 | |

| Loan End Use Verification | 1 |

| Equity Share Capital | ₹45,57,01,620.00 |

| $55,56,971.38 | |

| Preference Share Capital | ₹12,06,50,000.00 |

| $14,71,244.71 | |

| Preference Share Capital-CCPS | ₹41,57,33,850.00 |

| $50,69,591.60 | |

| Total Assets (Rs.) | ₹19,19,02,02,779.00 |

| $23,40,11,473.55 | |

| Total Staff | 3,567 |

Customer Testimonials

Member Name : Paramjit Kaur W/o Varinder Singh

Member Name : Paramjit Kaur W/o Varinder Singh

R/o Village Jarkhar Distt. Ludhiana

I am associated with Midland Microfin Limited from last 3years. I have taken loan of Rs. 15000/- two times from Midland Microfin Limited. I took the loan for Business Expansion. I am very happy and now I earn good amount and is able to fulfil all my needs.

Member Name : Usha Rani W/o Lt. Ashok Kumar

Member Name : Usha Rani W/o Lt. Ashok Kumar

R/o Gandhi Basti Distt. Faridkot.

I am associated with Midland Microfin Limited from last 2years. After The death of my husband I decided to start my own business of stitching clothes and for that purpose I needed money. At that time I took loan from Midland Microfin Limited for starting my business and I am thankful to Midland Microfin Limited who helped me in the time of my need. Now I have good income and can take care of my family.

Member Name : Sita Devi w/o Sanjay

Member Name : Sita Devi w/o Sanjay

R/o Pathana Mohalla Panipat

I used to sell Bed sheet, Pillow covers and other covers by making designs on them. I took loan from Midland Microfin Limited and invested the same in my business. It helped me to expand my business. I want Midland Microfin Limited to provide loan to other people like me so that they can also grow their business. I am very thankful to Midland Microfin Limited.

Member Name : Gita w/o Jagdish

Member Name : Gita w/o Jagdish

R/o village Rahda Distt. Assandh

I took loan from Midland Microfin Limited to expand my stitching business, it not only helped my business to grow but also increased my self-confidence. I wish to stay connected with Midland Microfin Limited in future as well so that I can further grow my business. Now I can fullfill the needs of my family, growth in business has helped improve the financial condition of our family.

© Midland Microfin Limited