04:32 PM Saturday, 27 July 2024

1800 137 0600

Toll Free

* 9:00 AM to 5:30 PM

1800 137 0600 Toll Free * 9:00 AM to 5:30 PM

-

Formation of Joint Liability Groups

A woman interested for loan is asked to bring four more members who are known to her and can stand guarantee for the loan disbursed, for each other. The groups must be organised by the likeminded borrowers and not imposed by the Centre Officer.

- The members should be from nearby areas, known to each other and should trust each other well enough to take up joint liability for individual loans.

- Members may be from different occupations.

- The members should not be in blood relation with each other.

- The group or centre may not comprise of majority of people from the same community

- Economic condition & Education qualification.

- A passbook is issued to each group member to record the loan disbursed and as well as the repayments. A simultaneous loan record register is also maintained by the Centre Officer.

-

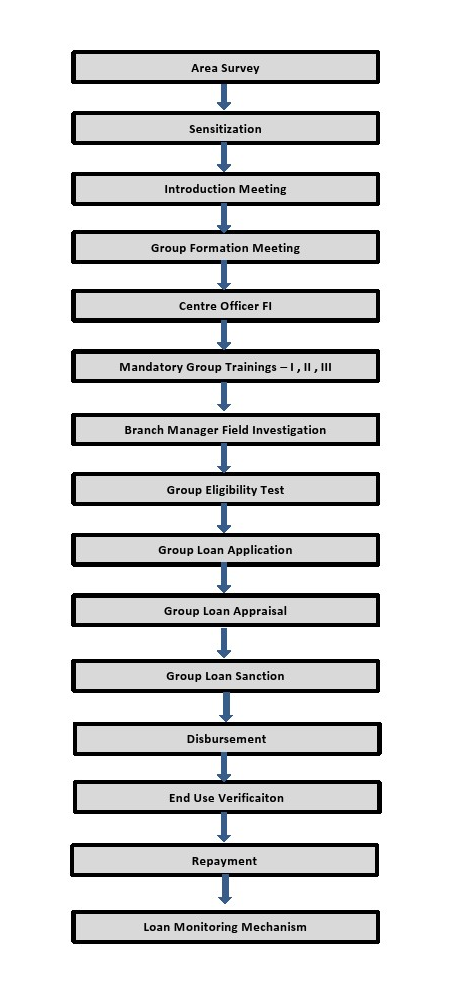

Process Flow Chart

Area Survey

Area survey refers to gathering the information of area from the local natives regarding the population, living standard, economic activities, credit discipline& existing number of banks & other financial institutions.

Sensitization

Midland Microfin runs an awareness campaign before the launch of its operations in the area. An area wise extensive Sensitization regarding JLG lending concept is undertaken. Modules are designed to generate awareness about the general content and structure of the joint liability groups as well as about the regular meetings, which would be taking place. To achieve this, key people in the area are made aware about the program. Initial Customer Interaction is conducted and people are made aware about the products and benefits of microfinance. In order to educate the people about the concept of micro finance in detail, meetings are called by the branches as well as Senior officials from Head Office along with Branch Managers and Centre Officers at a pre-decided venue and time. Sensitisation further helps us to develop the business relationship and to take the decision to promote our business.

Introduction Meeting

Introduction meetings are conducted and people are made aware about the products and benefits of microfinance by explaining the concept as well as on the spot clarification of the doubts. Interested people are then asked to form groups according to the criteria, which is clearly explained during Introduction Meetings.

Group Formation Meeting (GFM)

GFM is conducted after the members fulfill the criteria. Member and group characteristics are checked and hence groups are formed while members are asked to bring documents for KYC. Customer Profile Forms are filled. Customer Scoring is done by rating the customer on different parameters. The repayment capacity is also assessed based upon the information collected by the Field functionaries.

Mandatory Group Trainings (MGTs)

Three MGTs are conducted at different dates. Members are made aware about the products and its benefits. Lending process & policies are informed in detail and members are trained with regard to credit discipline.

Field Investigation

Detailed Field Investigation (FI) of the each member is done on a prescribed format. There are separate FI forms for different businesses.

Group Eligibility Test (GET)

GET is an interactive meeting with the members. It is conducted by higher officials from Head Office which recognise the group members according to the laid down criteria for availing the loan. If the group is passed the documents are forwarded to the Head Office for sanctioning of the loans.

Sanctioning Process

Midland Microfin has upgraded to automised online loan appraisal mechanism which enables us to reduce turnaround time for delivering credit to borrowers and has also improved our internal efficiency for faster processing of files with improved monitoring and enhanced portfolio quality. The company has recruited Credit Executives at Branch Level, who will properly scrutinise all physical files and information supplied by member to our centre officer at branch level as per defined Credit Policy. After analysing and cross verifying the credentials, verified details of Customer Profile Form are entered into BR.Net software and certain information by scanning few physical forms are supplied to Head Office Credit Officer for further analysis and appraising. The information for making a credit decision is sent to Head Office via FTP (File Transfer Protocol). A credit officer at Head Office again verifies all credentials as per defined quality parameters and also does cross verification with members telephonically.

Based on the verification of information provided by Branch Credit Executive and due diligence adopted by credit officer at head office a formal system generated ‘Appraisal cum Sanction Note’ is prepared. Thereafter sanctioning of loan cases are done at a Central Level by sanctioning authority and conveyed to the branches two days prior to disbursement day.

Disbursement

Sanctioned loan amount and terms & conditions of the contract are being communicated/explained beforehand to the members/groups and accordingly decision to avail loan is being taken by the members. Signing of the contract and completion of requisite documentation will take place and loan will be disbursed. The mode of disbursement will vary (Cashless/Physical Cash) as per choice of the borrower.

Collection of Installments

Customers attend centre meetings at fortnightly intervals. Installments are paid by members during the meetings. Installments are handed over to Group Co-ordinator who further hands it to the Centre Officer makes entries in customers pass books and minutes register, which is kept at the centre.

End Use Verification (EUV)

The End Use Verification (EUV) of the loan is done by planning a visit to each borrower’s place of business between 14 days from disbursement to ascertain the utilization of the loan. During the visit, it is determined that the money has been put to use for the purpose indicated by the borrower at the time of processing of the loan. If money has been put to use for the specified purpose, it is recorded and report is prepared regarding the end use verification.

If in case money has not been put to use, it is communicated that the money be spent immediately for the stated purpose. If money has been spent for purposes other than those specified, it is recorded and communicated. The borrower is counselled and informed about the outcome associated and how it can affect the prospects of the next loan. It is also ensured that this is communicated to all members of the group.

Loan Monitoring Mechanism

We have in place a robust post disbursement monitoring mechanism. With the help of this mechanism we see the progress of the borrowers’ businesses and monitor how much they progress and increase their income levels. This also helps in improving our risk management and mitigation capabilities. Monitoring the performance of the borrower is based on the progress reports prepared through visits and supervision. Also at each Centre Meeting we work at further developing strong relationships with our customers and understanding their day to day change in lifestyle and how the increased income levels are bringing about a positive outlook in their work and personal life.

-

Training

Midland Microfin has a lot of focus on meticulous training of the staff. Our strong belief is “Learn to work and work to Learn”. The new recruits are trained in three different phases.

Classroom Training

This includes orientation training covering the concept clarity, followed by detailed sessions of process training. The training focuses on developing practical and applicable skills for microfinance. Intense technical sessions are taken. These training sessions include a number of role-plays. The training sessions are followed by interactive sessions.

Field Training

Staff members undergo field exposure and practical fieldwork to familiarize themselves with various processes. This includes attending meetings like introduction meetings, group formation meetings, mandatory group training, field investigations, and center meetings. As part of the “Field Exposure” program, they visit branches for 2-3 days to gain insights into its routine work and engage in other field activities. This experience provides them with a comprehensive understanding of field operations and prepares them for their roles.

System Training

The staff is given detailed software training by creating a Mock Local Area Network. They are taught how to open accounts in the system and how to carryout daily reporting, MIS etc.

Formation of Joint Liability Groups

A woman interested for loan is asked to bring four more members who are known to her and can stand guarantee for the loan disbursed, for each other. The groups must be organised by the likeminded borrowers and not imposed by the Centre Officer.

- The members should be from nearby areas, known to each other and should trust each other well enough to take up joint liability for individual loans.

- Members may be from different occupations.

- The members should not be in blood relation with each other.

- The group or centre may not comprise of majority of people from the same community

- Economic condition & Education qualification.

- A passbook is issued to each group member to record the loan disbursed and as well as the repayments. A simultaneous loan record register is also maintained by the Centre Officer.

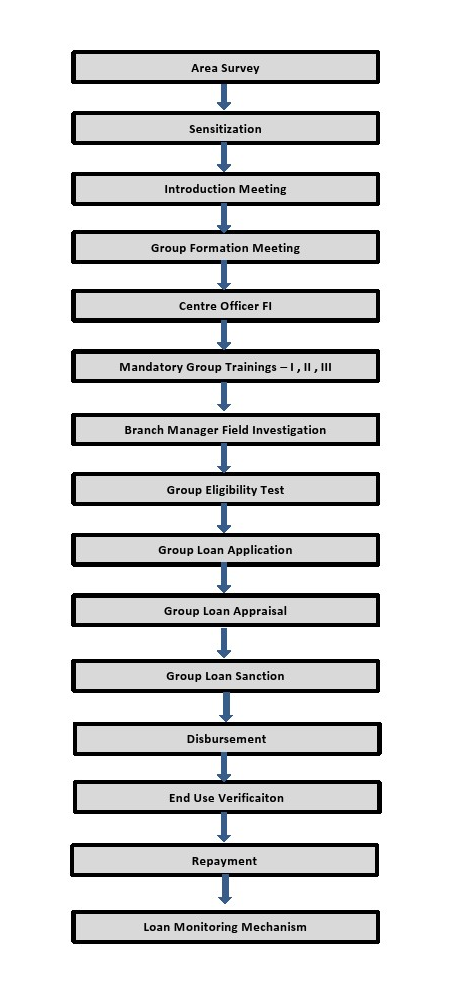

Process Flow Chart

Area Survey

Area survey refers to gathering the information of area from the local natives regarding the population, living standard, economic activities, credit discipline& existing number of banks & other financial institutions.

Sensitization

Midland Microfin runs an awareness campaign before the launch of its operations in the area. An area wise extensive Sensitization regarding JLG lending concept is undertaken. Modules are designed to generate awareness about the general content and structure of the joint liability groups as well as about the regular meetings, which would be taking place. To achieve this, key people in the area are made aware about the program. Initial Customer Interaction is conducted and people are made aware about the products and benefits of microfinance. In order to educate the people about the concept of micro finance in detail, meetings are called by the branches as well as Senior officials from Head Office along with Branch Managers and Centre Officers at a pre-decided venue and time. Sensitisation further helps us to develop the business relationship and to take the decision to promote our business.

Introduction Meeting

Introduction meetings are conducted and people are made aware about the products and benefits of microfinance by explaining the concept as well as on the spot clarification of the doubts. Interested people are then asked to form groups according to the criteria, which is clearly explained during Introduction Meetings.

Group Formation Meeting (GFM)

GFM is conducted after the members fulfill the criteria. Member and group characteristics are checked and hence groups are formed while members are asked to bring documents for KYC. Customer Profile Forms are filled. Customer Scoring is done by rating the customer on different parameters. The repayment capacity is also assessed based upon the information collected by the Field functionaries.

Mandatory Group Trainings (MGTs)

Three MGTs are conducted at different dates. Members are made aware about the products and its benefits. Lending process & policies are informed in detail and members are trained with regard to credit discipline.

Field Investigation

Detailed Field Investigation (FI) of the each member is done on a prescribed format. There are separate FI forms for different businesses.

Group Eligibility Test (GET)

GET is an interactive meeting with the members. It is conducted by higher officials from Head Office which recognise the group members according to the laid down criteria for availing the loan. If the group is passed the documents are forwarded to the Head Office for sanctioning of the loans.

Sanctioning Process

Midland Microfin has upgraded to automised online loan appraisal mechanism which enables us to reduce turnaround time for delivering credit to borrowers and has also improved our internal efficiency for faster processing of files with improved monitoring and enhanced portfolio quality. The company has recruited Credit Executives at Branch Level, who will properly scrutinise all physical files and information supplied by member to our centre officer at branch level as per defined Credit Policy. After analysing and cross verifying the credentials, verified details of Customer Profile Form are entered into BR.Net software and certain information by scanning few physical forms are supplied to Head Office Credit Officer for further analysis and appraising. The information for making a credit decision is sent to Head Office via FTP (File Transfer Protocol). A credit officer at Head Office again verifies all credentials as per defined quality parameters and also does cross verification with members telephonically.

Based on the verification of information provided by Branch Credit Executive and due diligence adopted by credit officer at head office a formal system generated ‘Appraisal cum Sanction Note’ is prepared. Thereafter sanctioning of loan cases are done at a Central Level by sanctioning authority and conveyed to the branches two days prior to disbursement day.

Disbursement

Sanctioned loan amount and terms & conditions of the contract are being communicated/explained beforehand to the members/groups and accordingly decision to avail loan is being taken by the members. Signing of the contract and completion of requisite documentation will take place and loan will be disbursed. The mode of disbursement will vary (Cashless/Physical Cash) as per choice of the borrower.

Collection of Installments

Customers attend centre meetings at fortnightly intervals. Installments are paid by members during the meetings. Installments are handed over to Group Co-ordinator who further hands it to the Centre Officer makes entries in customers pass books and minutes register, which is kept at the centre.

End Use Verification (EUV)

The End Use Verification (EUV) of the loan is done by planning a visit to each borrower’s place of business between 14 days from disbursement to ascertain the utilization of the loan. During the visit, it is determined that the money has been put to use for the purpose indicated by the borrower at the time of processing of the loan. If money has been put to use for the specified purpose, it is recorded and report is prepared regarding the end use verification.

If in case money has not been put to use, it is communicated that the money be spent immediately for the stated purpose. If money has been spent for purposes other than those specified, it is recorded and communicated. The borrower is counselled and informed about the outcome associated and how it can affect the prospects of the next loan. It is also ensured that this is communicated to all members of the group.

Loan Monitoring Mechanism

We have in place a robust post disbursement monitoring mechanism. With the help of this mechanism we see the progress of the borrowers’ businesses and monitor how much they progress and increase their income levels. This also helps in improving our risk management and mitigation capabilities. Monitoring the performance of the borrower is based on the progress reports prepared through visits and supervision. Also at each Centre Meeting we work at further developing strong relationships with our customers and understanding their day to day change in lifestyle and how the increased income levels are bringing about a positive outlook in their work and personal life.

Training

Midland Microfin has a lot of focus on meticulous training of the staff. Our strong belief is “Learn to work and work to Learn”. The new recruits are trained in three different phases.

Classroom Training

This includes orientation training covering the concept clarity, followed by detailed sessions of process training. The training focuses on developing practical and applicable skills for microfinance. Intense technical sessions are taken. These training sessions include a number of role-plays. The training sessions are followed by interactive sessions.

Field Training

Staff members undergo field exposure and practical fieldwork to familiarize themselves with various processes. This includes attending meetings like introduction meetings, group formation meetings, mandatory group training, field investigations, and center meetings. As part of the “Field Exposure” program, they visit branches for 2-3 days to gain insights into its routine work and engage in other field activities. This experience provides them with a comprehensive understanding of field operations and prepares them for their roles.

System Training

The staff is given detailed software training by creating a Mock Local Area Network. They are taught how to open accounts in the system and how to carryout daily reporting, MIS etc.

© Midland Microfin Limited